TurboTax tips for Lyft Drivers: So, you’re a Lyft driver and planning to use TurboTax? Great choice on tax software, as they’ve recently updated their Self-Employed edition to be even more thorough for rideshare drivers, including Lyft.

Here are some quick tips for using TurboTax as a Lyft driver. If you are self-employed, consider our coupons for up to 50% off the Self-Employed edition of Quickbooks or TurboTax!

TurboTax for Lyft: How It Works | Forms & Paying Taxes | Best Software?

How It Works + Tax Deductions

*Related: 37 Tips & Secrets for Lyft Drivers

Forms & Paying Taxes

TurboTax forms for Lyft drivers: Being a Lyft partner and owning your own business means that you are not going to get a W2 from Lyft, but you will get some other tax forms.

Because you aren’t getting a W2, that means that Lyft isn’t withholding any taxes for you. You are responsible for those taxes, but it will all be part of the tax return that TurboTax Self-Employed helps prepare for you when you file your tax return.

• Lyft Will Send You 2 Tax Forms:

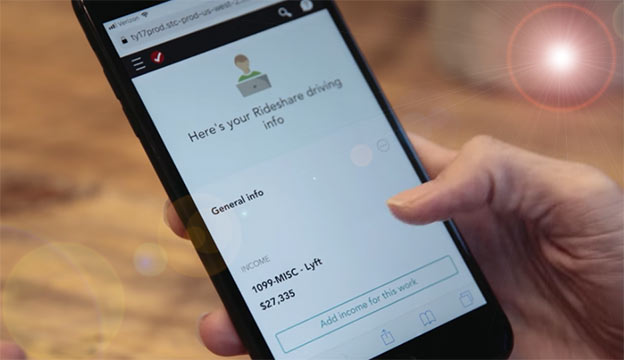

The tax forms you will receive from Lyft are a 1099k and a 1099 MISC. To see those forms in TurboTax, go to the dashboard and click on the “tax document” link.

- The 1099k is income from actually driving someone. So, every time you actually have someone in the car, that will be on the 1099k form

- The 1099-MISC is income that Lyft is paying you directly, like income from bonuses, referrals, etc.

• Lyft-Related expenses are tax deductions!

Also in the dashboard is the Lyft driver summary. Here you’ll find some of the expenses you’ll be able to take as deductions against your Lyft income. These expenses can be easily entered in the TurboTax app in categories including vehicle, supplies, taxes, and licenses.

So, if you’re using the Self-Employed Edition, the software will guide you through where to put each of the items, so that you get the most out of your potential tax refund!

H&R Block also makes a version of their software, especially for the self-employed, and we have a review here.

Best Tax Software?

We believe that these are the two best tax software options for Lyft drivers:

- TurboTax Self-Employed: A very thorough and simple version of TurboTax designed especially for those who work for themselves, own a small business or have multiple incomes.

- H&R Block Self-Employed: Very comparable to TurboTax, this is a great second option for ride-share drivers. (Today’s coupons)

- Quickbooks: If you are a small business owner, check out our coupons for QuickBooks Online! (Or, try a free trial)

• TurboTax for Lyft Drivers

So, you have a lucrative side gig as a Lyft driver? Although TurboTax can’t help you with traffic or rude customers, the good news is that come tax season, you’ll have a lot of potential tax write-offs to deduct against your Lyft income.

TurboTax’s “Self-Employed” edition is best for ride-share drivers, covering all the deductions you deserve. Remember, a single missed deduction can cost you hundreds of dollars, so when it comes to choosing tax software, don’t go cheap! Go with a top name, and then get the best price by using a coupon.

*Note that TurboTax’s free version is not appropriate for the complex taxes of the self-employed, even though their advertising infers that anyone can use it.

Ridesharing & Tax Filing: For more tips for filing taxes as a Lyft driver, check out: Tax tips for Lyft drivers at TurboTax.com