Tax Day: Two words that strike fear into the hearts of many. Yet this annual ritual of paying the piper won’t be going anywhere soon. Taxes help finance schools, fix roads, staff firehouses, and pay police officers, but Americans have a long history of hating (and revolting against) paying taxes.

Here’s a list of bad things Americans would rather do instead of taxes, plus a history of where all this hatred came from:

A List of Things People Would Rather Do Than Taxes:

Can you imagine never having to pay taxes? A survey by WalletHub asked Americans to do so, and found that there are a lot of things that they would do to never pay taxes again. Here are some bad things that people say they’d rather do than taxes:

- Clean public toilets (11%)

- Get a small tattoo that says “IRS” (27%)

- Move to a different country (16%)

- Stop talking for six months (10%)

- Spend a month in prison (4%) – Wow!

- Kill a stranger, without getting caught (4%!?)

- Do two loads of laundry (77%)

- Cook Thanksgiving Dinner for their in-laws (47%)

- Break their arm (8%)

- Change a (strange?) baby’s diaper (43%)

- Fold 100 fitted sheets (32%) – Those are annoying!

- Miss their connecting flight at the airport (23%)

- Spend a night in prison (13%)

When given the choice between preparing their taxes and other unpleasant activities, a surprising number of people chose the latter.

*In one survey, 35% of people said they would rather explain sex to their children than prepare their taxes!

According to this data, tax preparation is less popular than O.J. Simpson!

When Did Americans Hatred of Taxes Start?

“Let me tell you how it will be,

There’s one for you, nineteen for me,

‘Cause I’m the taxman, yeah, I’m the taxman” – Taxman, The Beatles

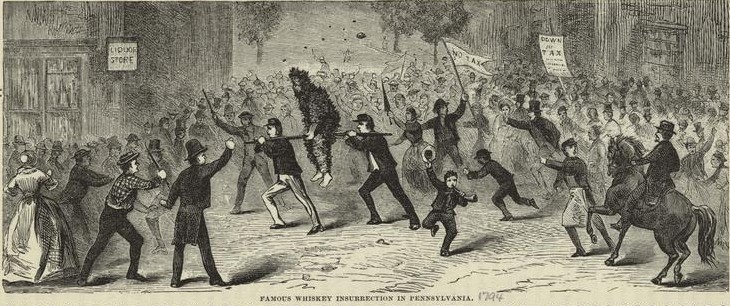

This hatred of death and taxes is about as American as it gets. Americans have been protesting taxes as far back as 1765 when the British levied the Stamp Act to pay for the cost of British military “protection” of the colonies. The Stamp Act was a tax on all newspapers, playing cards, pamphlets, and legal paperwork in the American colonies, and was instantly despised.

The colonists revolted against it, crying “No taxation without representation,” and the Act was repealed. This win eventually led to the Boston Tea Party (a protest against taxes and the first corporate bailout) and the ultimate in tax revolts, the American Revolution.

Americans’ hatred of taxes didn’t diminish after the British were defeated, as the first attempt to tax a domestic product in 1791 quickly led to protest and The Whiskey Rebellion!

Conservatives Seem to Hate Taxes the Most

For conservatives, there may be a perception that paying taxes means paying for those who aren’t paying their fair share.

Nobel prize winning economist Milton Friedman believed that “cutting taxes under any circumstances and for any excuse, for any reason, whenever it’s possible” is always the best strategy. The promise of tax cuts has paid off for many conservative politicians in recent history, including Donald Trump’s controversial “corporate tax cuts.”

“cutting taxes under any circumstances and for any excuse, for any reason, whenever it’s possible” is always the best strategy, and, indeed, the promise of tax cuts has paid off for many conservative politicians.

In addition to funding the military and keeping schools open, taxes also support government programs referred to as entitlements such as Medicaid and Social Security. For some conservative voters, the word “entitlements” has become synonymous with “handouts,” something they would prefer not to support with their own hard-earned salaries.

The TEA Party movement (their name an acronym for “Taxed Enough Already”) adds another layer of conservativism to the mix, believing that paying taxes is another form of government intrusion into private life that is simply unnecessary.

Libertarians have long believed that the government should stay out of all private life, but the TEA Party’s main ideology focuses on lowering or eliminating taxes altogether as an unnecessary hardship.

*Related: Does Vistaprint Still Offer Free business Cards?

Hatred of Taxes: Warren Buffet & The Perception of Unfairness

Another reason that Americans hate paying taxes so much has less to do with how much they are paying and more to do with how little others are paying.

In fact, 82% of Americans believe that corporations don’t pay their fair share of taxes, and 79% of Americans think that the rich don’t pay their share of taxes.

Recently Bernie Sanders ran on a campaign platform that included raising taxes on corporations and the wealthy to make them to pay their fair share. This has roots in Warren Buffet’s 2011 observation that he, a billionaire forty times over, paid less tax as a percentage of his income than his secretary.

While this assertion has been debated in recent years, Buffet released his tax returns in 2016 to debunk claims that he took massive deductions to avoid paying taxes.

Warren Buffet’s effective tax rate? 16.9%, about the same rate for single filers who make no more than $37,650 a year.

Buffett’s response to this inequity between what he pays and what others pay?

“We need Congress, right now, to enact a minimum tax on high incomes. I would suggest 30 percent of taxable income between $1 million and $10 million, and 35 percent on amounts above that. A plain and simple rule like that will block the efforts of lobbyists, lawyers and contribution-hungry legislators to keep the ultrarich paying rates well below those incurred by people with income just a tiny fraction of ours.”

While Buffet’s company continues to take advantage of current tax law to minimize their tax bill, they still recognize that taxes pay for important programs in the United States. This may be one of the most contentious parts of why people hate paying taxes: how their money is spent.

How the Government Wastes Your Tax Money:

According to the Center on Budget and Policy Priorities, taxes paid by Americans go to the following federal programs:

- Social Security: Approximately 24% of the annual tax dollars collected go to fund Social Security, this nation’s primary fund for retirement and beneficiary benefits (for widowed spouses and children under 18 whose parent has died).

- Medicare, Medicaid, CHIP, and ACA subsidies: Covering the spectrum of health needs for those who are less fortunate, 25% of our tax bill goes to support these programs. Of that 25%, two-thirds goes to Medicare, the program for people over 65 or those who have disabilities.

- Defense spending: The British were right; occupying countries is expensive! For defense programs domestic and abroad, 16%+ of every tax dollar gets funneled into defense for everything from running the Pentagon to staffing the war in Afghanistan.

- Other: Safety net programs, transportation, and infrastructure programs are just a few of the programs that utilize the remaining tax dollars, about $362 billion dollars in 2015.

Getting the American public to agree on exactly how much of our tax dollars to go where is as difficult as getting Congress to agree on nearly anything these days. When you don’t agree with the government’s spending priorities, it’s not a big leap to see that you might not agree with handing over any percent of your income to support programs you don’t believe in!

The current tax code is confusing and complicated, and even though 72% of Americans believe the tax code should be overhauled, it seems to be here to stay.

An Overly Complicated Code Inspires Hatred!

In many other countries like Spain, Sweden, and Denmark, filing your taxes is free, and not so complicated. This idea of “free tax filing” was actually supported in America by politicians including President Ronald Reagan and (then Senator) Barack Obama, so why didn’t it become a reality?

Much of the reason is apparently because Intuit, the company behind TurboTax, spends millions of dollars each year lobbying the government to make sure you can’t prepare your taxes for free. Paying an accountant or using tax preparation software (like TurboTax and HR Block) at an average cost of $290 per tax return, therefore, becomes a necessity, further adding to our hatred of doing taxes. Thanks a lot, Turbo Tax!

Well, maybe at least there’s some satisfaction in wrestling your money back from Uncle Sam in the form of tax deductions?

Anyway, thanks for visiting Pretty Sweet!